4 Crucial Components to Automate Accounts Payable

The accounts payable process is absolutely critical to ensuring your business pays its creditors on time, but with various approval levels, manual data entry, and stacks and stacks of paper, this process can not only be an exhausting chore but a drain on company resources and productivity.

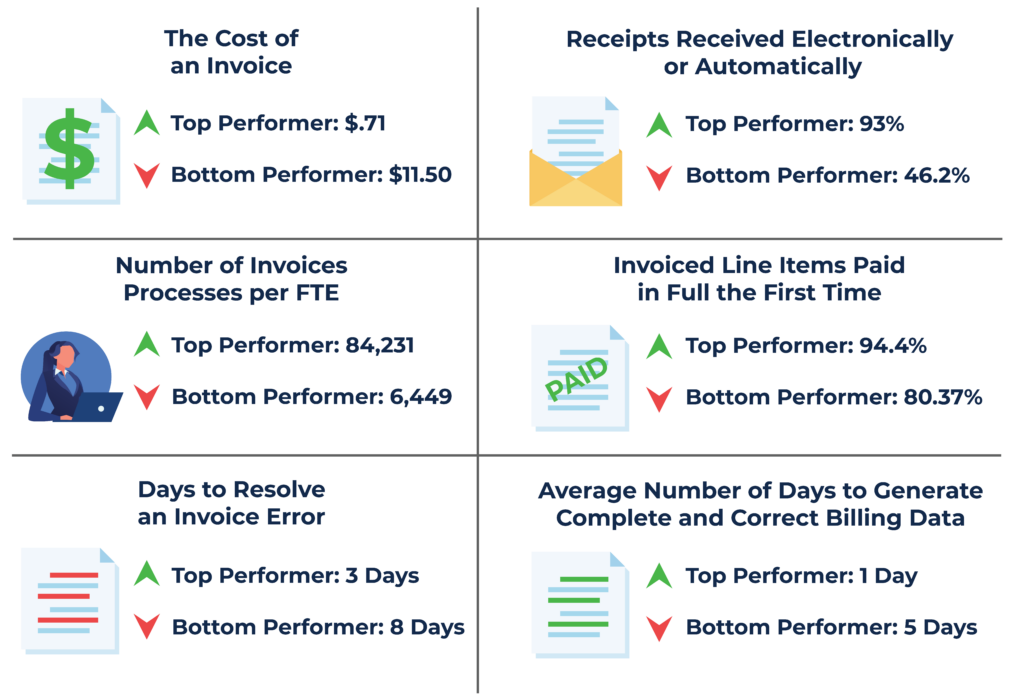

But it doesn’t have to be this way. Data from The American Productivity and Quality Center illustrates the difference between top and bottom-performing company’s accounts payable processes:

For top performers, the cost of an invoice is only $0.71, while for a bottom performer, it could cost up to $11.50. Similarly, top performers process 84,231 invoices per full-time equivalent, while bottom performers only process 6,449.

Many other disparities also exist between top and bottom performers, all exhibited in the graphic above, raising the question: How do top performers complete the accounts payable process with such efficiency?

The simple answer is to transform this process with new automation technologies, but when deciding which technologies will make the most impact on productivity, employee satisfaction, and the bottom line, the answer becomes a bit more complicated.

The Most Impactful Accounts Payable Automation Components

Enterprise Content Management

Invoices, purchase orders, delivery receipts, and other documents vital to the accounts payable process are frequently referenced during communications with vendors and during time-consuming paperwork tasks such as the three-way match, where information from an invoice is matched to that on a purchase order and delivery receipt. The frequency with which these documents are referenced often leads to wasted time trying to locate them as clerks sift through cabinet after cabinet trying to find the correct file.

This is why enterprise content management makes a world of difference. By scanning and storing each document in a digital repository and applying index fields such as PO Number and Vendor Name, documents can be retrieved at any time, securely and conveniently. Users can even often apply account-based permissions to documents to prevent unwanted access.

Optical Character Recognition

If manually indexing each document sounds exactly like the kind of productivity sink you’re trying to solve, then you’d be right. That’s where optical character recognition, or OCR, comes into play. This software reads your scanned documents, PDFs, or any other file formats that typically can’t be leveraged by a computer, extracting key information and eliminating manual data entry.

Optical Character Recognition solutions may even be able to integrate with your financial system to fuel it with data from these documents as well.

Ultimately OCR reduces errors by eliminating keystrokes and makes time available to tend to more business-centric tasks.

To find out more about OCR, potential strategies, and how to leverage it, view our expert guide for OCR

Artificial Intelligence

Artificial intelligence or AI can also significantly improve the bottom line when used in the accounts payable process. By implementing AI into your Optical Character Recognition solution; you can save drastically on document templates.

To clarify, when using OCR, documents are often captured by mapping data points you want to extract to specific points on the page. The result is a template, each unique to any given document format. So, if your vendors’ invoices all look different, you’ll need unique templates for each, all involving the work of a professional services team.

AI solves this by removing templates from the situation entirely, intelligently identifying the information on the page, and saving your organization from professional services costs in the process.

Workflow Automation

The accounts payable process is also often riddled with bottlenecks as invoices frequently need to be signed off on by multiple approvers. By automating workflows, documents can be instantly routed to approvers, and reminders can be sent at regular intervals, ensuring a smooth transition as the documents traverse your organization.

How Square 9 Can Help

Paper-based work is a soul-crushing, profit-sapping drag on individual, team, and company productivity. Paper literally smothers innovation, creating a competitive disadvantage.

Square 9’s award-winning platform takes the paper out of work with complete, scalable solutions for Enterprise Content Management; Optical Character Recognition; workflow automation; and web forms, saving time; reducing errors; and boosting productivity. To find out more about transforming your accounts payable department for the better, view our expert guide for accounts payable or contact us.